This post is about solving the investing problem. Or at least, an attempt to solve it optimally.

From economics’ point of view, we want to maximise the utility of scarce resources (e.g.: our money) by minimising the waste (e.g.: loss). With that, we could become more productive (e.g.: wealthier) then we currently are without requiring additional work or resources. We want to get more out of what is currently available to us by being more efficient.

Following the same reasoning, we can approximate investing as a minimax problem. In other words, it is an optimisation problem. The optimal solution would lead us to minimising risk while maximising return. We want to gain as much as possible from our capital while avoiding all possible losses.

min(risk) then max(return)

Note: min(risk) means minimising risk and max(return) means maximising return.

min(risk) comes first before max(return). Without min(risk), the max(return) is meaningless: We might lose it all no matter how high our return is. We need to look at the downsides before looking at the upsides.

Be able to successfully transport the treasure out of a cave full of explosives while using a burning torch doesn’t negate the fact that you are an idiot.

min(risk) involves minimising the potential of losses. The first rule of investment success is to never lose money. Or to minimise the losses.

Example: If we lose 50 % of our capital, it takes us 100 % gain to break even. It is common sense then that the more we lose, the harder it is to get ahead. It is easier to get a satisfactory result if we never lose money. Therefore, min(risk) is important.

With min(risk), we can make tons of mistakes and still turn out fine. Without, making one mistake will get us into trouble.

The Relationship Between Risk and Reward

Investing involves risk. Therefore, we must examine the relationship between risk and reward.

Common sense has it that the higher the risk, the greater the return. But this is only true up to a certain extend. Higher risk also means greater probability of ruin.

When taking high risk, there are two possible extreme outcomes: extremely good or extremely bad results. The latter is more probable than the former. If we take extreme risk, the end result would most probably be bad. Therefore, higher risk does not always lead to higher return.

However, if no risk is taken, no change will happen. We need to somehow take some risk to achieve our objective to maximising our return.

Risk Paradox

It is bad when we take no risk at all. It is also bad when we take extreme risk. There is a dilemma.

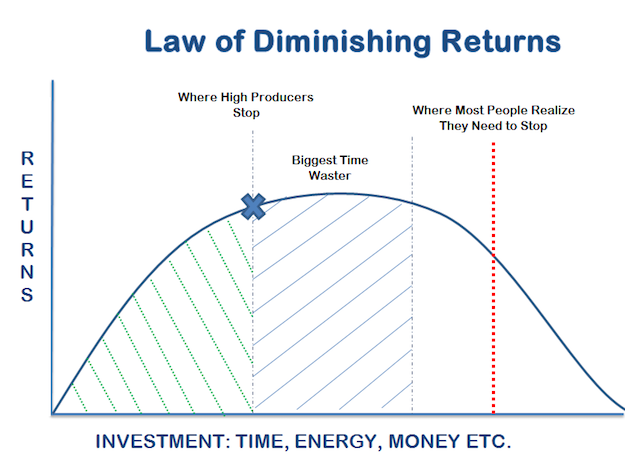

One of the fundamental principle in economics (refer to Naked Economics: Undressing the Dismal Science) could help us deal with this dilemma. It is called the law of diminishing returns which states roughly that increasing investments (e.g.: in production) will lead to increasing returns but only up to a point. From that point onwards, more investments will lead to decreasing returns.

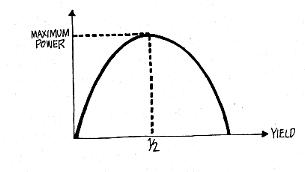

That law can be summarised with an inverted-U curve below.

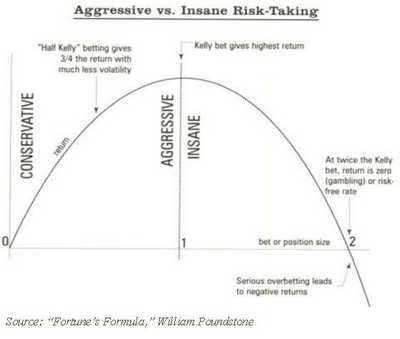

Kelly criterion (refer to Fortune’s Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street), which is a formula used of optimal money management in investing or betting, is also having a shape of an inverted-U curve.

Another example would be the use of salt in our everyday life. If we don’t use salt at all in cooking, the food will be tasteless. Adding a little bit of salt will make the food tastier. However, adding too much salt will spoil the meal. This phenomenon can also be represented by the inverted-U curve.

The inverted-U curve describes the non-linear characteristic of reality. It tells us that more is not always good just like risk. There is an optimal point between the two extremes where the return is maximised.

Being inspired by the above observations, we know that the optimal risk level is somewhere in the middle. Most people don’t like risk. In fact, people are risk-adverse by default as proven in prospect theory (refer to Thinking, Fast and Slow). But the greatest return is achieved by taking a moderate risk. To compromise, we need to make the risk as low as possible but not lower. The concept is similar to what Albert Einstein had famously said “Everything should be made as simple as possible, but not simpler”. The same for risk, it should be kept as low as possible, but not lower.

How to min(risk)?

We learn that we could increase our odd of success by keeping risk as low as possible but not lower.

Here are some pointers to reduce the risk of ruin.

- invest for the long term: countless of studies have shown that the longer we invest (e.g.: ten years and beyond), the least likely we are to lose money.

- invest in low volatility stocks: high volatility stocks are always considered as high risk stocks. Low volatility stocks have the opposite effect. With lower volatility stocks, we can keep the risk as low as possible. Low volatility stocks are the result of less people looking at them. They tend therefore to be under-priced or overlooked by others.

- invest in companies with cash: cash is king. Companies with plenty of cash can weather financial storms much better than companies with no cash.

- acquire cheap asset by buying at low price: margin of safety. The wider the margin of safety, the lower the risk. In investing, the more we overpay for something, the higher the risk of losing money.

- diversify: diversification is the only free lunch in the market. It avoids the non-systemic risk of investing in a single company. Diversify in 25 to 30 stocks has lower risk than concentrating on single stock.

- avoid leverage: leverage is good when time is good. It is a disaster when time is bad. We need to make sure our investment can weather all seasons by avoiding leverage.

- invest in knowledge: read and learn as much financial knowledge as possible. Knowledge reduces risk. Being able to think independently is critical when investing.

How to max(return)?

After keeping the risk under control, it is time to focus on max(return).

- find growth in earnings: not all growth is created equal. Some growth is organic (e.g.: high returns on capital) which may be slow but steady. Some growth is artificial (e.g.: over-investment) which may be fast but non-sustainable.

- find the least capital intensive companies: some companies are cash cows. Some companies require large R&D cost, have machines to maintain, etc. The companies will have more money to return to shareholders if they don’t need those money.

- follow dividend/income: more than 50 % of total stock returns over the past several decade are coming from dividends.

- buy low when there is maximum pessimism: margin of safety. Margin of safety lets us kill two birds with one stone by creating low-risk and high return investments. This is often called value investing. It works and continues to work simply due to its imperfection: it will under-perform the market over short-term. People avoid under-performing stocks. Also, looking at the price range of any company over 52-week period, we notice that something is not right. How could a company’s value change so much in so short time? The market must be pricing the company terribly wrong at certain point. We could take advantage of that mispricing.

- favour small cap: size matters. It is easier for a company with $10 million market-cap to grow to $1000 million than a company with $10 billion market-cap to grow to $1000 billion.

- minimise cost: trading cost matters. Keep cost low. 1 % fee means 1 % lower return.

- minimise number of trades: the more frequent you buy and sell, the more miserable your results and your life are.

- be patient: stocks take time to turn into a 100-baggers. 25-years are the average time for a stock to return a 100-bagger.

- stay away from the stock market: out of sight, out of mind. We make better decisions without the influence of Mr Market.

Styles of Investing

Knowing how to min(risk) and max(return), we can come up with an infinity of styles of investing.

Currently, there are many documents that describe different styles of investing which incorporate the min(risk) and max(return) approach. Here is a list of applications for reference:

- How to Make a Million Slowly (Financial Times Series): focus on small cap, low price-to-earnings ration and high dividend yield

- Contrarian Investment Strategies: The Psychological Edge: be a contrarian and buy low PE companies

- High Returns from Low Risk: A Remarkable Stock Market Paradox: buy low volatility stocks

- The Little Book That Beats the Market (Little Books. Big Profits): buy high return on capital and high earning yield (magic formula) companies

- Quantitative Momentum: A Practitioner’s Guide to Building a Momentum-Based Stock Selection System (Wiley Finance): buy momentum in stocks

- Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk: buy momentum in asset classes

- The Busy Doctor’s Investment Guide: How One Adjustment Per Month Can Save and Maintain Your Portfolio’s Health: monthly rotation and rebalancing

- Get Rich with Dividends: A Proven System for Earning Double-Digit Returns (Agora Series): get rich with dividends

- Templeton’s Way with Money: Strategies and Philosophy of a Legendary Investor: go global

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market: buy what you know

- The Intelligent Investor, Rev. Ed (Collins Business Essentials): buy value stocks guided by the trinity of Mr Market + margin of safety + business

- 100 Baggers: Stocks That Return 100-To-1 and How to Find Them: build a coffee can portfolio

There are many roads that lead to Rome.

Whether it is a long-term (passive) or short-term (active) style.

I prefer long-term and passive investing with the minimum maintenance investment like timberland investment. This is because timber just grows year in and year out with no human intervention. It protects us against inflation and deflation. We can never have enough of it.

Harvard University invests a lot of its endowment fund in timberland in Brazil and Australia (refer to The Alternative Answer: The Nontraditional Investments That Drive the World’s Best Performing Portfolios).

Buying companies that grow like timberland make me sleep sound and nice at night. This is the objective of solving the investing problem.

Short-term and active investment style using momentum is another possibility but more work is required. It all depends on personal preference.

Final Thoughts

Emotion moves the stock price. It makes the price fluctuates. It is also contagious.

People are either shunned by volatility or addicted by it: extreme cases where in one case people avoid the market completely while in another case people are taking too much risk.

Know your limit else the reality will teach you a costly lesson.

It is easy to understand why some people are addicted to high volatility stocks: they lead to get-rich-quick fallacy. Stocks that double in day are wonderful. Stocks that halve in a single day is another story.

Be a contrarian by buying low volatility stocks is one example.

Another possibility is to make use of volatility. Volatility is value investors’ best friend. For value investors, volatility is not a risk. It is a tool for us to buy low and cheap. We can take advantage of it.

Investing using min(risk) and max(return) approach is a good bet. We have a lot of wonderful results documented in the list of reference above. The world of investing is full of possibilities.