Update 140312: Want free RM 500?

I opened a Public Mutual fund account last month through a part-time agent who works in the same company as me. The account was approved recently.

The main reason I was attracted by the fund initially was that I could invest using my EPF (Employee Provident Fund) saving (from account 1, if you are wondering). I thought to myself since I cannot touch the money in account 1 until I reach my retirement age, why not use the money to invest in something the might generate higher return?

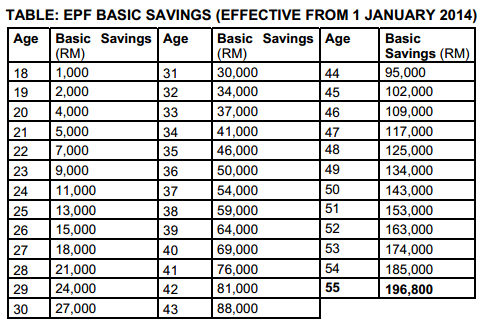

There are certain requirements to meet:

EPF Basic Saving* (Account 1)

| Age (Year) | Basic Savings (RM) | Age (Year) | Basic Savings (RM) |

| 18 | 1,000 | 37 | 34,000 |

| 19 | 2,000 | 38 | 37,000 |

| 20 | 3,000 | 39 | 41,000 |

| 21 | 4,000 | 40 | 44,000 |

| 22 | 5,000 | 41 | 48,000 |

| 23 | 7,000 | 42 | 51,000 |

| 24 | 8,000 | 43 | 55,000 |

| 25 | 9,000 | 44 | 59,000 |

| 26 | 11,000 | 45 | 64,000 |

| 27 | 12,000 | 46 | 68,000 |

| 28 | 14,000 | 47 | 73,000 |

| 29 | 16,000 | 48 | 78,000 |

| 30 | 18,000 | 49 | 84,000 |

| 31 | 20,000 | 50 | 90,000 |

| 32 | 22,000 | 51 | 96,000 |

| 33 | 24,000 | 52 | 102,000 |

| 34 | 26,000 | 53 | 109,000 |

| 35 | 29,000 | 54 | 116,000 |

| 36 | 32,000 | 55 | 120,000 |

(* the above table is no longer up-to-date, source)

You need to have at least a certain amount of saving in your EPF account 1 according to your current age. For example, I am 28 year-old and I will need to have RM 14000 21000 plus at least RM 5000 in account 1 (which means a total of RM 19000 26000) to be able to invest in the Public Mutual EPF Investment Scheme. The additional RM 5000 is the minimum requirement to be eligible for the program. You can only invest 20 % of the additional money of your account 1. In the example, the additional money available is equal to RM 5000 (19000 – 14000 26000 – 21000) and 20 % of it equals to RM 1000. You can use the RM 1000 to invest in the funds.

The bad news is: I only start working for about 18-9 months and my saving in account 1 is still not meeting the minimum requirement of the program. To add insult to injury, I was informed by the public mutual agent (another agent) recently that the basic saving table was being revised and the minimum saving required was increased to RM 21000 for those who are 28 year-old. That means I will need to have at least RM 26000 (21000 + 5000) to be eligible to the program. There is still a long time to go before I can benefit from the EPF investment scheme. 🙁

However, there is an alternative to invest in Public Mutual funds: using cash. The fee is about 5.5 % (3% for EPF investment scheme). By cash, you can invest any amount you want. But you will be charged 5.5 % for each purchase.

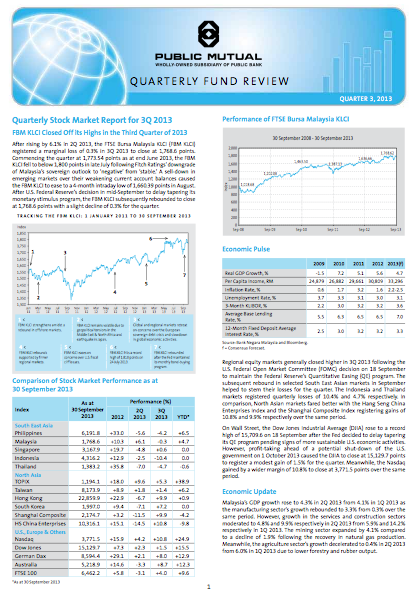

There are many funds to choose from. You can get the catalog that reviews all the available funds here:

You can track the real time price of the funds here:

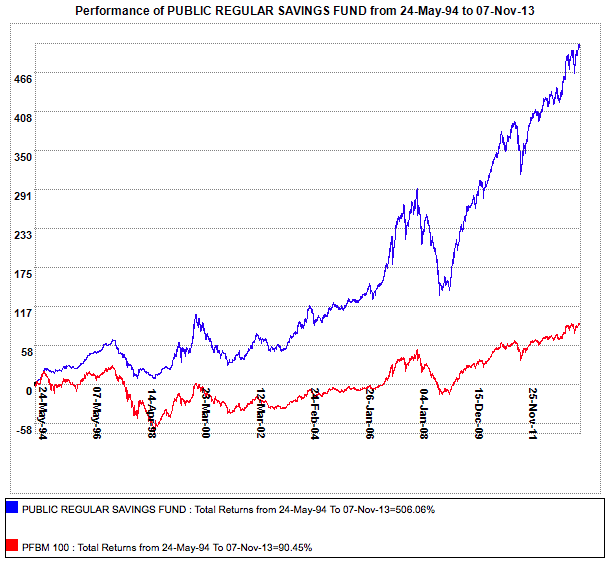

You can also look at the recent performance of the funds here:

The performance for this particular fund “Public Regular Savings Fund” seems too good to be true: 500 % for around 20 years which translates to about 8.38 % annualized return!

The good thing about cash investment is that you can do it online from here. You will need to apply for access first by referring to the website.

Book to learn more about Mutual Fund

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition